Long Reads Sunday #99

Happy Sunday from the Hudson Valley

This week was somewhat less wild than last week (no bankrupt company stocks dominating the headlines), but there remains a gnawing question of how sustainable the complete untethering of financial markets from the real economy is. In our main topic, I look why the long anticipated generational transfer of wealth simply might not happen, and why, in that context, the Robinhood ralliers look even more like an insurgency on an economy that they’ve (correctly) identified isn’t designed to serve them.

More on that after the news and podcasts. Happy Long Reads

NLW

P.S. I haven’t dug into this DeFi surge and yield farming, but point to a couple resources at the end.

This Week’s Top Bitcoin & Crypto News

Bolton’s book says Trump told Mnuchin to go after bitcoin

OKCoin and BitMEX join forces to support a bitcoin core dev

Polkadot is exploring redeemable bitcoin tokens

Compound is definitely the belle of this week’s DeFi ball

Bitcoin bank River Financial raises $5.7m

Binance is launching a new, regulated exchange in the UK

Crypto debit card issuer Wirecard says it is missing $2.1B

Crypto Dad raises eyebrows, coming out for XRP and saying it isn’t a security

Canada is recruiting for a lead for their CBDC project

South Korea’s central bank has formed a research group to focus on a central bank digital currency

According to JPMorgan, the last few months have seen bitcoin pass a key stress test

This week on The Breakdown podcast

Monday | Sorry, Bloomberg: Here Are 6 Reasons Why 2020 Is a Great Year for Bitcoin A Bloomberg senior editor today argued there were six reasons why 2020 was bad for bitcoin. Here’s the opposite case.

Tuesday | The Fed's Folly: From Moral Hazard to Business as Usual, Feat. Jesse Felder A leading independent financial analysis shares thoughts on the “Robinhood rally,” Fed policy and why Modern Monetary Theory (MMT) is already here

Wednesday | The Satoshi-fication of Social Media: Why The Future Is Pseudoanonymous, Feat. The Crypto Dog A conversation about pseudo-anonymity, global digital nomadism and the trader’s mindset

Thursday | 6 Things Jobless Claims Tell Us About the State of the Real Economy Persistent unemployment and fears of further layoffs are the real economic counterpoint to the financial market’s unbridled enthusiasm.

Friday | Why Monetary Debasement Is Here to Stay, Feat. Dr. Vikram Mansharamani From technology to aging demographics, some of the most important trends shaping the economy have been deflationary. What happens when that rapidly changes?

Saturday | A Dozen+ Statistics Proving Millennials Are F%#$&D: The Breakdown Weekly Recap An economic comparison of where boomers were at the same age as millennials leads to only one conclusion: Millennials are screwed.

Our Main Theme: A Generational Wealth Transfer That Isn’t Coming

So here’s something interesting.

The generational wealth transfer is the concept that, while Boomers have disproportionate assets and resources, as Boomers age out of the economy and Millennials and Gen Z come to positions of greater leadership, that will shift.

But what if the premise is fundamentally flawed?

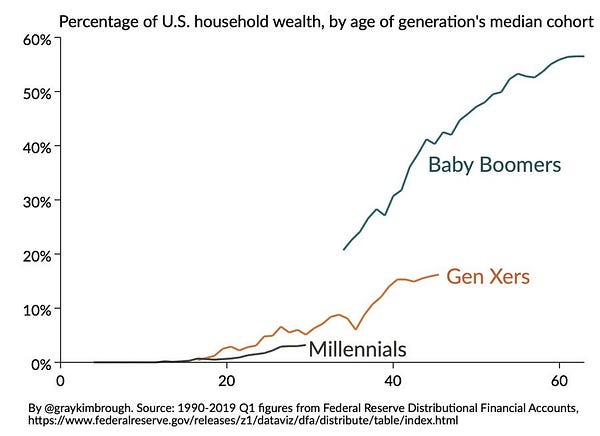

First, let’s take a look at the state of generational wealth right now. While it may be popular in certain circles to rip on Millennials, empirically speaking they are starting with a worse economic hand than generations

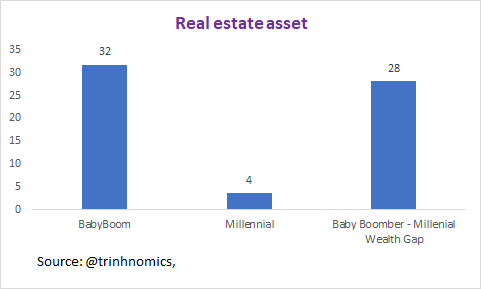

But how does this translate into ownership of real assets and other comparative placements in the economy? Let’s look at this epic thread.

There are simply so many numbers that tell this same story.

Meltem Demirors picked up a similar theme on Thursday.

Economist Gray Kimbrough, as well.

But here’s the most interesting (and terrifying) point.

The presumption is that, even if behind currently, this transfer eventually begins to happen.

But what if it doesn’t?

What if unfunded liabilities, underfunded pensions, market crashes, etc create a scenario where the retirement plans of those Boomers are completely upended, and they have to use all those assets at their disposal simply to survive?

This is not impossible.

And viewed in this light, the Robinhood rally seems to start to take on a different meaning.

What if, instead of just a bunch of bored sports gamblers, this group instead represents the Barbarians at the gates of the United States of the Federal Reserve? A group that has gotten farther and farther behind as asset prices rise and make it more unattainable to buy into the system.

In that light, the sort of strategies employed by r/WallStreetBets and moreover, the near total price nihilism and intransigent unwillingness to give even one shit about fundamentals are simply a group that has been systematically excluded trying to reclaim some power.

If you’re interested in this take, I highly recommend this week’s Hidden Forces episode with Tony Greer.

As an aside, I listen to a lot of macro podcasts. Like, basically all that I can.

Bitcoin is coming up constantly, in a much more natural way than ever before. Something is definitely shifting.

Bonus Theme: Yield Farming

Last note, there is an absolute EXPLOSION of discussion around DeFi and Yield Farming. I haven’t had the chance to really wrap my head around it, so instead of commenting I’m just going to point you to a few of the resources I’ve seen.

nice post - have some further charts about the "boomer blockade" here: https://think-boundless.com/the-boomer-blockade/