Happy Sunday from the Hudson Valley

This week was an interesting in between. After months and months of discussion and debate, the halving finally came and went - most notable for its banal predictability. It is, indeed, this predictability, consistency and immutability of bitcoin’s monetary policy that makes it stand out in today’s environment.

Reflections on the halving are one of three mini-themes this week, along with questions of a “deflationary supercycle,” and, of course, JK Rowling’s unfortunate stumble into the depths of bitcoin twitter.

First, I want to share the third in my special documentary series “Money Reimagined” on The Breakdown. The episode released Friday is all about what role bitcoin has in a global monetary order hungry for an alternative to the expansionary policy that has animated central banks for more than a decade. Listen to that by clicking below:

Okay, top news and the podcast rundown briefly, then on to our 3 mini themes. Happy Long Reads - NLW.

This Week’s Top Bitcoin & Crypto News

The Libra Association has added a set of new members to its roster, including a Singaporean state-owned firm

Telegram has abandoned its blockchain ambitions. Surprise surprise, investors are looking into a lawsuit around the $1.7B token sale

JPMorgan is now officially banking crypto companies, with Gemini and Coinbase coming first

Reddit is rolling out Ethereum-based tokens for two of its subreddits

The IRS is scouting for help to get serious (and seriously accurate) about crypto taxes

Grammy winning RAC has launched a tokenized cassette tape with the Ethereum-based Zora marketplace.

The European Central Bank is working on a “retail central bank digital currency”

An exodus of whales from ether to bitcoin?

Chainlink releases a new oracle for provable randomness with PoolTogether

Bitcoin rewards startup Lolli raises $3m, led by Founders Fund

dYdX launches a new decentralized marketplace for bitcoin perpetual contracts

This week on The Breakdown podcast

Monday | The Great Monetary Inflation: Paul Tudor Jones' Complete Case For Bitcoin

Tuesday | How We Future Now - Live With Kathleen Breitman, Caitlin Long and More

Wednesday | A Coming Reckoning: Why The Fed Can't Outspend Deflation, feat. Jeff Booth

Thursday | Surveying The Carnage: Movies, Sports, and Education in Crisis

Friday | The Great Inflation Escape: Where Bitcoin Fits In the New Monetary Order [Money Reimagined Pt. 3]

Theme 1: Reflections on the Halving

After so much debating (“is it priced in?!”) it was frankly nice to get to the other side of this event. Start with this piece from Allen Farrington, one of the best writers you don’t know yet.

Lucas Nuzzi from CoinMetrics gave a presentation at CoinDesk’s Consensus:Distributed event about everything that had transpired in the 4 years between this and the last halving event.

Su Zhu argued that, for as much attention as it feels like was focused was on this, we’re still actually nutso early.

Still, I think that Balaji’s tweet really nails the ironic power of the event: it was, ultimately, the fact that it was so predictable, fixed and ignorant of any new outside conditions that made it stand out relative to all other global monetary policies.

Importantly, when we look back at the story of this halving, not only that contrast but the new influx of institutional attention it brought in will be front and center.

Theme 2: Is it inflation or deflation we should be worried about?

“Money Printer Go Brrr” is undoubtedly the most resonant meme of the moment (outside, perhaps, the Ghanian funeral dance). Interestingly, there is an open debate about whether what we should be worried about is inflation or deflation.

On Wednesday, Jeff Booth joined The Breakdown to discuss what he sees as perhaps the most quintessential economic struggle of our time: the interplay of technology-wrought deflation with inflationary monetary policy.

Real Vision’s Raoul Pal also discusses a deflationary recession in this video on CoinTelegraph.

CryptoNephillim did an excellent job curating many of this ideas in this old school LRS-style thread.

Chamath meanwhile tweeted out this Foreign Policy article arguing forcefully that it is deflation not inflation that is likely to cause harm.

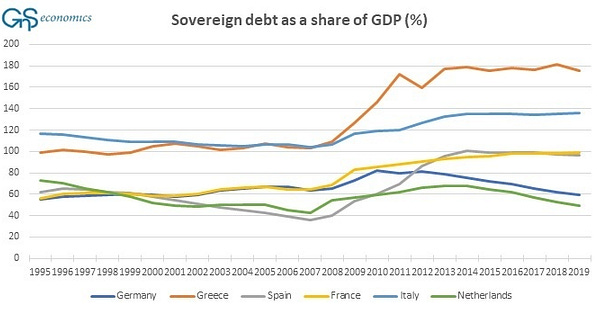

Another part of that FP article is the idea that inflation isn’t - as Friedman put it - a monetary problem, but a political problem. That context makes for an interesting reading of the challenge faced by Europe right now.

This question of deflation or inflation feels like one of the most important of the moment and is a theme I’m going to continue to explore here and on The Breakdown.

Theme 3: Harry Potter and the Over-Aggressing Twitter Community

It was also innocent; so cool; such a fun way to end a great week.

At first it was really fun things like this:

But then it was like we were determined to demonstrate why we can’t have nice things.

Still, it was a pretty fun time. My favorite tweets (and subtweets) came from Zooko and Erik Voorhees.

Can’t think of a better place to wrap than that!

Cheers, all.