Happy Sunday from the Hudson Valley,

For the first time in what feels like a very long time, this week wasn’t (totally) dominated by the COVID conversation. That has less to do with a big shift in the fight against COVID and more to do with the bitcoin halving being right around the corner. On this LRS, we look at that halving excitement.

I’m also thrilled to share the launch of The Breakdown: Money Reimagined. It’s a 4-part narrative documentary style podcast exploring the battle for the future of money. The first episode - “Why The Dollar Has Never Been Stronger Or More Set Up To Fail” - came out Friday.

Happy Long Reads

-NLW

This Week’s Top Bitcoin & Crypto News

A first for Uniswap with the UMA token sale

Ooooops. 87% drop in XRP sales for Ripple in Q1

A16Z announces second massive $515m crypto fund

Tezos is now working with Chainlink for decentralized pricing oracles

Under pressure from the SEC, Telegram offers to return $1.2B in token sales to investors

Binance is launching a mining pool

The Libra Association gets a new member in Checkout.com

Genesis has a massive Q1 with $2B in new loan issuance

Data analytics and trading platform Skew announces $5m venture round

Bummer. Pro-crypto CFTC commissioner Brian Quintenz will not seek another term

Samsung adds Tron dapps to the Galaxy Store.

This week on The Breakdown podcast

Monday | Bitcoin vs. QE Infinity: The 4 Archetypes Of The Halving Debate

Wednesday | When Currencies Fail: A Primer on the Crisis in Lebanon

Thursday | From Corrupt To Broken: An Insider’s Analysis Of The Fed, feat. Danielle DiMartino Booth

Friday | Why The Dollar Has Never Been Stronger Or More Set Up To Fail [Money Reimagined Pt. 1]

As I mentioned above, Friday’s episode kicked off a new documentary microseries. It features contributions from Matthew Graham, Caitlin Long, Scott Melker, Kevin Kelly, Ben Hunt, Luke Gromen, Travis Kling, Mark Yusko, Anthony Pompliano, Jared Dillian, Dave Portnoy, Michael Casey, Preston Pysh, Peter Zeihan.

Our Main Theme: Excitement Returns Around The Halving

When it comes to bitcoin, the last couple months have seen at least as much narrative volatility as actual price volatility.

When bitcoin crashed in early March alongside equities markets, some were quick to call the death of the digital gold or store of value narrative. Even the “uncorrelated” narrative had a hard time passing the sniff test as bitcoin found itself in one of its most correlated periods ever.

Yet as the eye-poppingly sized stimulus bills started to pass, a new (old) narrative started to settle in.

In a nutshell, the contrast between bitcoin and its hard capped supply and fiat and its “unlimited” printing has never been greater.

Interestingly, one of the standard-bearers for the mainstreaming of questions around unlimited money printing is the founder of Barstool Sports.

At the beginning of the week, we also got the latest from Plan B - a third in his series of essays on the Stock-to-Flow model focused on a cross asset analysis.

By the way, here’s a simple tweet storm version of it.

But of course, the real excitement came when the markets started to run. After starting the week hovering around $7700, bitcoin smashed up all the way to $9400 before retracing slightly and hanging out around $8700-$8800. Importantly, this move broke it out of its correlated pattern with the stock market.

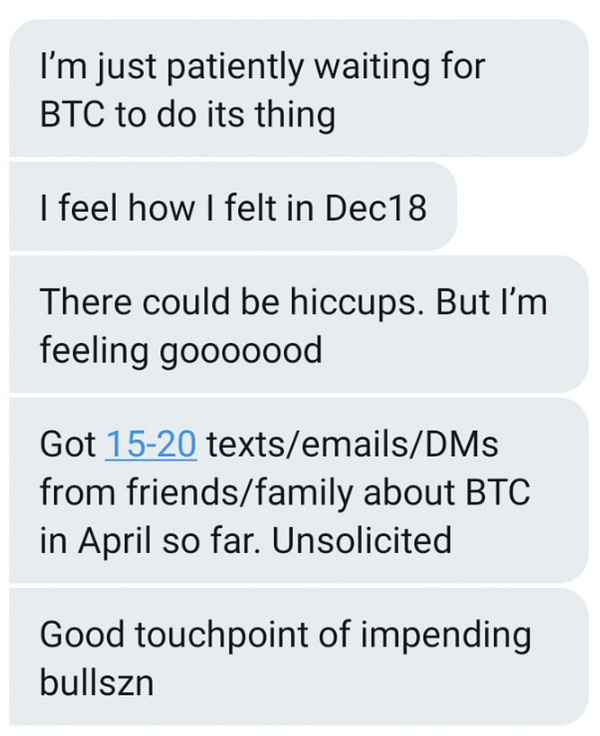

Anecdotally, bitcoin Twitter is posting a lot of messages like these suggesting that friends and family are starting to pay attention again.

This should only increase as more mainstream media attention turns back to the bitcoin space.

Check out Mark Yusko’s mic drop moment on the fundamentals

And finish it up with this clip where both the S2F model and the “quantitative hardening” term make it to CNBC.

We know what happens next. The right narrative + number go up brings FOMO and new people. And everytime those people discover that bitcoin hasn’t died again, it gets even more intense.

I’m reminded of these immortal words: