Long Reads Sunday #91

Is 'money printer go brrr' distracting us from the 'dollar wrecking ball?'

Happy Sunday from the Hudson Valley

Bit of a shorter edition today to spend some extra time with family. Top news and podcast rundown first, then a quick note on the two themes I think mattered most this week: the dollar debate.

Happy Long Reads

NLW

This Week’s Top Bitcoin & Crypto News

BitMEX launching a new ETH/USD futures product to be settled in bitcoin

Bloomberg says Bitcoin maturation is accelerating

Starbucks, McDonalds and Subway among the first testers for China’s digital currency

Argentina’s central bank is trialling a blockchain-based system for interbank settlement

Securitize launches a new peer-to-peer security token trading service

Coinbase releases a proprietary price oracle as it expands focus on DeFi

Dharma launches social crypto payments for Twitter

Blockstack opens testnet on new Proof of Transfer consensus mechanism

Tim Draper’s venture studio releases a WordPress plugin for crypto trading

Africa the next great payments battleground as Binance-backed crypto payments app launches

Libra adds 50 job openings in Ireland as well as a new Association member in Heifer International

On The Breakdown this week:

Monday | Bearish or Bullish? What Oil, DeFi Hacks and Cash Hoarding Tell Us About Markets

Tuesday | From Proof of Health to UBI: How Everything Changes Post COVID-19, Feat. Joe McCann

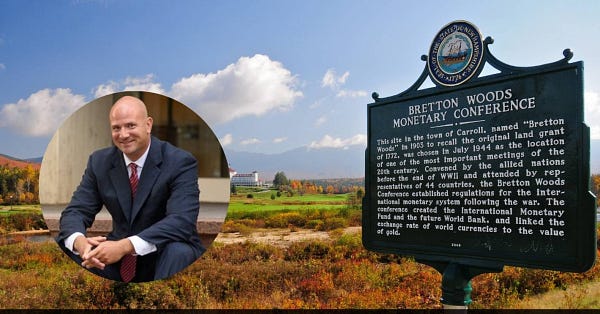

Wednesday | The History of the Dollar System From Bretton Woods to QE Infinity, Feat. Luke Gromen

Thursday | We Don’t Need Big Brother To Beat This Virus

Our Main Theme: The Dollar Debate

There are conflicting narratives around the dollar right now.

The first has to do with the potential for inflation caused by the Fed ramping up intervention. It is wonderfully memed with the huge array of “money printer go brrr” memes. It has made FinTwit look basically indistinguishable from Bitcoin.

At the same time, there are some who argue that the real concern isn’t some massive inflationary event, but instead lies in the dollar’s comparative strength around the world.

I believe this is one of the most important macro debates right now, and wanted to share a few starting points.

Ari David Paul does an incredible job frame setting around this topic. He gets into what happened after 2008, how MMT came to be and what it argues, what’s different between now and 2008, why debt deflation is the immediate term concern, and why investors are hedging the possibility of US inflation for the first time in 30 years.

Raoul Pal has been beating this drum for a while and argues that the money printer go brrr meme isn’t just wrong - it’s distracting.

Jill Carlson wrote a piece for CoinDesk this week that reflected many similar arguments.

Lyn Alden explains this concept further.

Dan Tapiero notes that in places where the currency is failing compared to USD, some are seeing premiums in p2p bitcoin trading.

This dollar shortage and demand has shown up in the massive increase in USD stablecoins in the last two months. Avi Felman from Blocktower and Max Bronstein wrote about the crypto-dollarization phenomena.

Coinbase co-founder Fred Ersham noticed this as well.

For more on this topic, a few resources.

First, check out my discussion with Luke Gromen that is effectively a TL;DR on the last 70 years of global monetary history.

Second, check out my conversation with Preston Pysh a few weeks ago about what happens when currencies fail.

Third, check out Preston Pysh’s interview with Jeff Booth.

Thanks as always for reading!