Long Reads Sunday #90

Happy Sunday from the Hudson Valley

Hope you had a great quarantine Easter weekend. We’ll start this edition with links to the top stories and some podcast shills and then get into the main theme: time to build - but what? And where? And for whom?

This Week’s Top Bitcoin & Crypto News

Just days after announcing a fundraise led by MultiCoin, China’s dForce loses $25m in locked value in an exploit

Binance SmartChain brings them into competition with Ethereum

China announces 71 members of National Blockchain Council and China-based Blockchain Service Network goes live

Crypto M&A: Shapeshift has acquired the non-custodial crypto wallet Portis

Ever more crypto M&A: BitGo has acquired institutional portfolio manager Lumina

Bitmain competitor MicroBT has unveiled 3 new mining devices in anticipation of the upcoming halving

Decentralized governance? Compound is going live with a decentralized governance token with support from Coinbase Custody

Speaking of Coinbase Custody, users are now able to delegate their Polkadot DOTs for staking via Bison Trails

OG bitcoin buying app Purse is shutting down after 6 years.

One other shutdown of note: a crypto exchanged focused on Telegram shuts down as their Token continues to be blocked

Atomic Loans raises nearly $2.5m from Initialized, Morgan Creek for decentralized BTC lending

Signs of life? As institutions return to the market, open interest in bitcoin futures with CME is up 70%

On The Breakdown this week:

Monday | Off

Tuesday | The $20,000 Human IPO & 5 Other Stories That Have Nothing to Do With COVID-19

Wednesday | What the Economy Will Look Like 6 Months From Now, Feat. Ryan Selkis

Thursday | Libra vs. China's DCEP? The Battle for the Future of Money Heats Up

Friday | Why Money Is Losing Its Meaning, feat. Jared Dillian

Our Main Theme: What Next?

So far as I can tell, there are basically two conversations happening right now.

The first is when to reopen the economy - a debate that has totally expectedly become highly politicized. For my part, I’ve been pretty clear on why I think it’s the wrong conversation to have.

The other conversation, which is much more interesting (albeit somewhat premature if we can’t actual reach an answer on that “how to open back up” question), is what does the world look like after?

Time to build

Anyone who has been on Twitter this weekend is almost guaranteed to have seen Marc Andreessen’s new essay shared ad infinitum.

The essay begins with an argument that the failure of Coronavirus was a failure of basically all of our institutions:

“This monumental failure of institutional effectiveness will reverberate for the rest of the decade, but it’s not too early to ask why, and what we need to do about it. Many of us would like to pin the cause on one political party or another, on one government or another. But the harsh reality is that it all failed — no Western country, or state, or city was prepared — and despite hard work and often extraordinary sacrifice by many people within these institutions. So the problem runs deeper than your favorite political opponent or your home nation.

This is a critique that will resonate with many in the bitcoin and crypto community.

Preston Byrne argued that this is a sea change and potentially realigning political and economic force.

Re-Onshoring (or De-Chinafication?)

One of the most significant re-evaluations happening right now is countries questioning how reliant they ought to be on global supply chains. At the epicenter of this is how countries feel about their relationship with China. We’ve already seen moves in places like Japan to politically and economically incentivize a shift away from China and to domestic production.

This is already and likely to get more politicized in the US as well, where we continue to deal with not just a general heightened sense of supply chain issues, but acute awareness of our (over?) reliance on China as relates to immediate COVID-19 fighting needs in PPE and testing reagents.

China, Blockchain and Digital Currency

China, for its part, continues to put the petal to the metal as relates to blockchain and digital currency. Notably, they:

Announced the 71 members of the National Blockchain Council - an advisory group meant to help set standards

Officially launched out of beta the Blockchain Service Network - basically a building block to make it easier and cheaper for enterprise and individual developers to plug into private permissioned and (outside of China at least) public blockchains

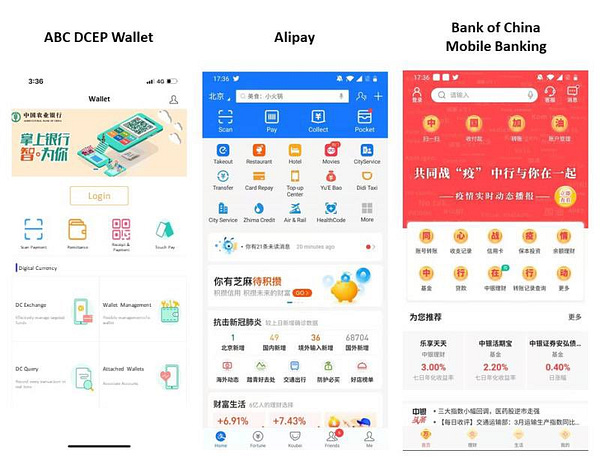

Had screenshots of the test app for their DCEP digital currency shared all over WeChat.

These moves shouldn’t be written off as just innovation theater or a PR stunt. Among other motivations, the BSN is an attempt to control what could become a key piece of internet infrastructure. The DCEP digital currency meanwhile is another tool to expand economic influence and in particular try to nudge aside the dollar as the default reserve currency within those spheres of influence.

To learn more about what we learned about DCEP, check out Matthew Graham’s thread.

Libra to the Rescue?

One project that has positioned itself (or tried to, at least) as a counterweight to China’s digital currency ambitions is Facebook's Libra. Last year, as regulatory criticism came in hot and heavy, it basically pivoted to a “if we don’t they will” message vis a vis China.

This week, we got a major update from the project. Instead of a basket of currencies approach, Libra will now be offering a number of individual fiat-pegged stablecoins. To some, this looks like them backing off their biggest ambition - a global reserve currency like Keynes imagined (he called his the ‘bancor’) - and converting into something closer to a consultant for governments that eventually want to launch their own CBDC.

The Demand for (Digital) Dollars

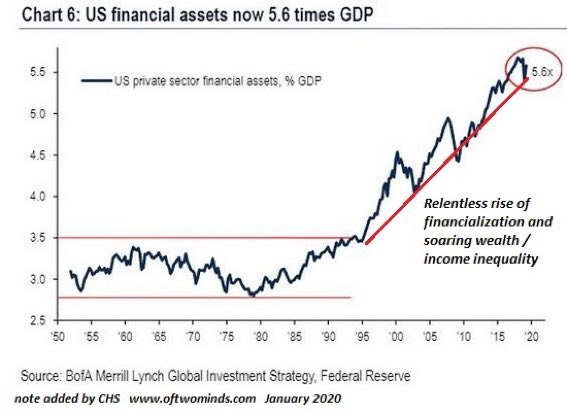

It certainly makes sense why China would be looking to curve the influence in the USD. In the heightened economic insecurity, demand for the dollar has been simply massive.

Nic Carter pointed out that this was something that some in the central bank establishment predicted.

The tale of the tape is clear. Demand for USD stablecoins has been so high that value transfer on Ethereum (think Tether on Ethereum) reached parity with bitcoin.

Cantillon Insiders: The Other Side of the Dollar

Of course, the dollar has another narrative as well.

Thanks for reading - NLW