Happy Sunday from the Hudson Valley,

It’s nearly 50 and sunny here, which is wonderful for February and also means it will probably dump snow this week. 🤷♂️

This week was much of the same - halving debates; CBDC developments; weird price quirks; the specter of impending macro doom - but with a twist. The attacks last weekend on bZx have brought a new adversarial thinking to DeFi that could be enormously beneficial in the long term. Let’s dive in!

LRS | 5 Themes That Defined The Week

Theme 5: Prices and Power

We had just gotten real settled in to this idea of $10k bitcoin when all of a sudden, in 5 minutes, the price crashed more than 5%.

Things are nudging back up over the weekend, and truth by told, people weren’t particularly freaked out about the dip. If anything, they were simply interested to see what others thought caused it.

Theme 5: The Halving

I joked a few months ago that the default conversation every day between now and the halving will be whether the halving is priced in. This week didn’t disappoint on that front.

We’ve got bets happening:

More commentary on the Efficient Markets Hypothesis from the ever excellent Allen Farrington

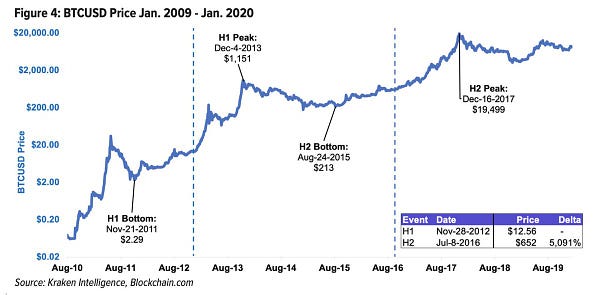

A deep dive report from Kraken

And one of the more interesting things I’ve seen (you know I love narrative discussions) recently - a discussion of the emergent categories of FUD leading into this halving.

Theme 3: Central Bank Digital Currency developments

Libra continues to shape the way the governments of the world are engaging with the digital currency space. This week, perhaps the most notable development in this domain was that Sweden was testing an e-krona, specifically calling out competition from private monies as a motivation.

Speaking of private monies, JPMorgan put out a report this weekend about the entire crypto space, but with an emphasis on stablecoins. Alex Kruger captures the shift in sentiment admirably

Lastly, in the newly-launched CoinDesk op-ed pages, Nic Carter argues that while some policymakers are looking nervously at cryptos and CBDCs as threatening the USD’s role as the world’s reserve currency, they haven’t much to worry about.

Theme 2: Macro and Corona

As has been the case for weeks and sadly will likely be the case for a long while to come, the inescapable background noise for everything in our little part of the economic world is a macro backdrop still trying to figure out the true implications of the Coronavirus.

The best thread of the week (or longer) connecting the dots between the economic underpinnings that already had bitcoiners nervous and this new shock to the system comes from Ikigai’s Hans Hauge

Delphi’s Kevin Kelly and Real Vision’s Raoul Pal both took to threads to paint the macro picture, with Raoul repeating his mantra of “Bonds. Dollars. Gold. Bitcoin”

Caitlin Long calls out worrisome indicators as it relates to the pension system…

Which, based on the response to this tweet of mine, is something that many are thinking about:

Speaking of which, in one of the absolutely best threads of the week, think tank director Oren Cass looks at how to reconcile economic statistics that suggest that workers are making slow, steady progress with the feeling that people are fali

One thing to watch for this week is, as Coronavirus comes to Europe and traditional markets get more and more spooked, will we see the mainstream perpetuation of the BTC-as-Safe-Haven narrative?

Theme 1: Adversarial Thinking Comes to DeFi

We discussed the first bZx attack last week, but then on Monday, a second attack happened, provoking even more reaction. For MyCrypto’s Taylor Monahan, it was at least partially about the team specifically involved:

Taylor also wrote a great debrief in the excellent “Our Network” newsletter.

Larry Cermack from The Block predicted “exploitation season” for DeFi - which I think perfectly sums up the new normal we might see.

The project that saw the highest uptick in adversarial thinking - i.e. thinking ahead to what attackers might try to exploit - was Maker. This makes sense, as it is the most essential and interconnected project in the space. The conversation quickly honed in on a proposed delay in governance so that if an attacker were able to take over the network, there would be time to respond before something catastrophic happened.

SpankChain’s Ameen Soleimani put some urgency behind the vote:

But by the end of the week, the change was made.

To me, this lends some credence to this idea that these attacks may end up being a positive thing for the nascent DeFi space as a whole.

This Week on The Breakdown podcast

Monday | Off

Tuesday | Is It Exploitation Season for DeFi?

Wednesday | Chainlink's Sergey Nazarov on What DeFi Can Learn From Early Exchange Hacks

Thursday | Why We Should Stop Thinking of ‘Crypto’ as a Single Industry

Friday | Diagnosing the Dip: Why Today's Leading Exchanges Are Powerful, but Not Inevitable

And lastly..

Don’t miss the The Simpsons explanation of crypto