Long Reads Sunday #83

Bull market narratives, DeFi hacks, distressed assets and the looming Coronavirus

Happy Sunday, all

This week’s LRS will be a little shorter than usual as I’m traveling with family, but I wanted to at least touch on some of the conversations that drove the week.

One of those themes was something of a settling in to a new bull market, and asking what was driving it and how it might play out the same or differently as in the past. I asked Twitter what was driving the shift in sentiment and interestingly, the BTC halving was by far and away people’s top answer, getting more than 50% of votes.

Even if the “digital currency battles” and “Fed policies” weren’t the top vote getters, it was hard to ignore comments last week from Fed chair Jerome Powell that Libra had “really lit a fire” when it came to exploring digital currencies.

Yet these weren’t the only notable comments from a US official. Testifying before the Senate Financial Services Committee, Treasury Secretary Steve Mnuchin said that there would be “significant new requirements” around cryptoassets (although there is some evidence that there may be a disconnect between the Secretary and FinCEN itself).

Reinforcing the notion that the US was going to continue to ratchet up enforcement to bring crypto to heel and put it in line with other categories of financial assets, news broke that the CEO of DropBit had been arrested and accused of more than $300m in money laundering associated with running a bitcoin mixer from 2014-2017.

The debate in the crypto community was largely about how much this case was about specific clearly illegal actions from an individual vs. precedent setting around mixers as a privacy preserving technology. Yet if this line from the official statement got the community nervous - "This indictment underscores that seeking to obscure virtual currency transactions in this way is a crime” - there were still voices for calm:

The markets themselves saw some activity that was eerily reminiscent to the ICO ‘glory’ days. Hedara Hashgraph’s HBAR was up massively on news that Google Cloud would be joining their governing council. SteemIt also popped on news that it would be purchased by Tron. As an interesting aside, ARCA’s Jeff Dorman made the argument that Tron is, at this point, effectively a distressed asset facility.

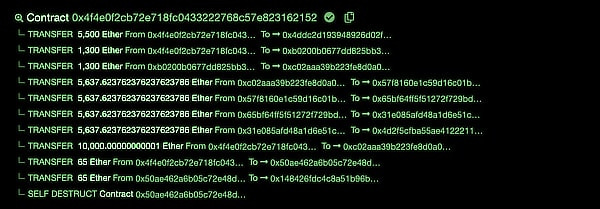

As the weekend came, Ethereans from around the world were flooding into Colorado for ETHDenver. Unfortunately, the major DeFi story wasn’t some new cool announcement, but the exploit of an interesting vulnerability. Alex Kruger summed it up in a tweet while Maya Zehavi broke down the response.

Lurking in the background of every conversation is the specter of the Coronavirus. This week, a large part of that discussion was dedicated to the Balaji vs. Media drama, but frankly, that too feels like distraction.

The more salient conversation and the one I’ve seen surprisingly little of is the potential economic fallout. Even in the absolutely best case scenario of everything being contained quickly, it still feels like we’re dreamwalking in some liminal in between before the economy has actually had a chance to react, with nothing good to follow.

Who knows. For now, if you’re interested, Messari’s Ryan Selkis has been putting serious attention on the virus.

This week on The Breakdown podcast

Monday | On the Frontlines of the SEC Safe Harbor Proposal With CoinList President Andy Bromberg

Tuesday | Muneeb Ali Explains Blockstack’s Big Bet on Bitcoin

Wednesday | Why Crypto Sentiment and Prices Are Soaring: Puppets, Pundits, Partnerships

Thursday | The US Government Sends Mixed Signals on Digital Currency Privacy

Friday | The Top Narratives Driving Crypto Market Growth feat. Travis Kling

Your moment of zen

Perhaps the craziest bullish moment of the week came from CNBC Fast Money, who in about 90 seconds covered every macro narrative you could imagine for explaining why Bitcoin was thriving in 2020.