Long Reads Sunday #101

Happy Sunday from the Hudson Valley,

This week’s edition is a little bit different. In the same way that I started LRS to capture the crypto Twitter commentary that is incredibly interesting but also fleeting, I’ve started keeping track of the broader macroeconomic conversation, as well.

I’ve just introduced a new monthly Breakdown podcast featured called the Macro Media Index - which is effectively a monthly LRS but for macro. I released it as a podcast and as a Twitter thread and so am including the thread version here.

There is one crypto story I wanted to discuss before that. Of course, it’s TikTok and Doge.

Here’s what happened.

A little more than a week ago, a TikTok user made a video pushing people to pump the price of Dogecoin. More users responded and the TikTokDogecoinChallenge was born.

As people started to notice…things started happening. Within a few days, the price of Doge was up 35% and volume was up nearly 2000%. There was more than a hint of 2017 in the air, although this time made even more interesting by the fact that there is intense geopolitical intrigue around the app.

I did a full podcast about TikTok Doge and CoinDesk produced this highlight video if you want to check it out.

Let me know what you think of the Macro Media Index below.

Happy Long Reads

NLW

This Week’s Top Bitcoin & Crypto News

A Coinbase IPO in the works?

BlockFi is also considering an IPO for 2021

DeFi reaches $2B locked up milestone

Appeals court rules that Bitfinex must face NY allegations over $850m in lost funds

Sri Lanka’s Central Bank has begun working on a blockchain-based KYC

China’s CBDC trial kicks up a notch with new partner ride sharing giant DiDi

Libra hasn’t fully given up its dream of a multi-currency basket backed coin

Iran has notified crypto miners they have one month to register with the government

Visa raises eyebrows with a job listing for an Ethereum developer

The CFTC has a 4-year plan for fostering innovation in crypto

Binance acquires crypto debit card company Swipe

Bitcoin and ethereum futures volumes fell significantly in June

Plus, the best meme:

This week on The Breakdown podcast

Monday | China Stocks Surge and NYC Real Estate Craters: 5 Stories Shaping Markets Today

Tuesday | Central Banks Cannot Print Jobs: Understanding Real Economic Recovery, feat. Daniel Lacalle

Wednesday | TikTok Doge Is Everything About 2020 Finance In One Story

Thursday | Social Chaos and Bankruptcy Rallies: The Best Insights From FinTwit June 2020

Friday | Against Outrage Culture: Why Michael Krieger Ended Liberty Blitzkrieg

Saturday | The Mixed Signals Economy: The Breakdown Weekly Recap

The Macro Media Index

Welcome to the Macro Media Index: The Best Macro Content from June

The themes of the month were market vs. economic recovery; wealth inequality and unrest; dollar debates and - of course - the Robinhood Rally.

If you want to understand the macroeconomic story of June 2020, this thread is for you

**

The month kicked off with the realization - a stunning one to many to be sure - that not only had the market come screaming back after March lows - it had done so with record vigor.

**

Some of the industries best thinkers came out and said that even they were somewhat surprised at just how well the Fed’s action would work.

**

Of course, peel back the data a little bit and what you get is a tale of (at least) two markets. In this case, there is tech — and there is everything else.

**

Then again, there are other tale of twos, as well - as @jessefelder explains here. One is the absolute chasm between prices and profits. Another, as Jeremy Grantham put it, is the top 1% of stock market valuations and the bottom 1% of economic outcomes

**

In such a strange context, there were some like @DTAPCAP who tried to ignore their priors and instead focus on what the data was telling them - a new asset/equities bull market.

**

Others, like 2020 macro breakout superstar @LynAldenContact, pointed out that if you price the S&P500 in gold rather than dollars, the charts make a hell of a lot more sense.

**

We also can’t discuss last month without discussing the massive social unrest. @vol_christopher made the point that, although the catalyst was discreet, the incredible rage and frustration had a bigger context

**

@NorthmanTrader was a little more on the nose with it.

**

However, for those looking for social unrest to show up in the markets, @krugermacro made the historical comparison to show that markets shrugging off upheaval was, in fact, the norm.

**

Still, folks like @LukeGromen argued that there was more generational and historical significance to the upheaval than perhaps we were giving it credit for.

**

@nic__carter brought #bitcoin into the story, arguing that while it couldn’t, on it’s own, fix the underlying problem, it was and is an important part of a new toolkit for a new age

**

Still, if there is one thing that June 2020 markets will be remembered for, it’s the Robinhood Rally. @avichal captured many of us bitcoin’s folks sentiment when he said this:

**

@PrestonPysh made the connection between the breakout sensation of @stoolpresidente and Portnoy’s recognition that the Fed is in the Shrute-buck-stocks-only-go-up-business, come hell or high-water

**

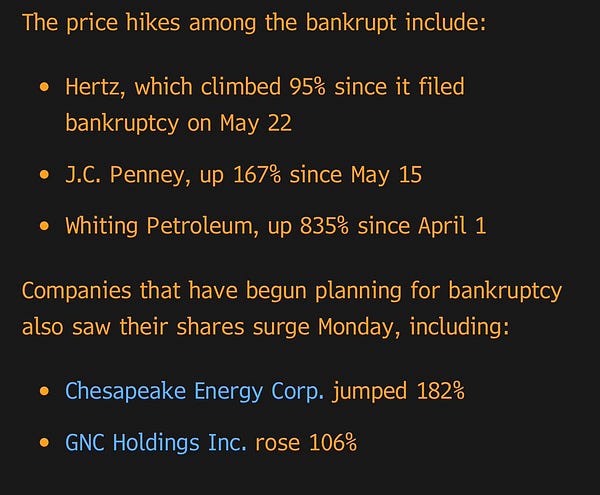

There was nothing that better encapsulated the month than the Hertz bankruptcy bet. @krugermacro said it was the second nuttiest thing of the COVID-19 crisis, after sub-$0 oil

**

@TheStalwart went farther, saying it was the craziest type of bubble he’d ever seen

**

@jessefelder took up the mania tracking mantle and wrote “One fo the Ages” https://thefelderreport.com/2020/06/10/one-for-the-ages/

**

Remember earlier when @biancoresearch said that the thing he (and many) missed was how much retail was going to pick up what the Fed was putting down? This was the point.

**

Shortened due to Substack length restrictions. Read the rest on Twitter